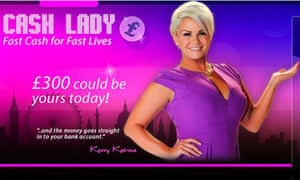

You’ve probably viewed ads exclaiming that one can “Receives a commission Now!” which have “Zero Credit score assessment!” The latest ads normally have images out of cheerful family before idyllic residential district homes. Just what enterprises powering those individuals adverts provide, regrettably, would not make you cheerful. These are typically offering payday loan with high charge and you may appeal which can make you worse out of than before.

Pay check lending try a beneficial $forty billion dollar world. On the better, such as for instance financing utilizes individuals who don’t possess cash or entry to borrowing from the bank. In the its terrible, it is a fraud.

- Pay day loan always fees extreme charges, of course, if you get behind on payments, they cost you sky-highest rates of interest that may enable it to be tough to catch up.

- Pay day loan businesses are will merely cons, however, even genuine of them may charge your cost which might be illegal lower than Ca law.

- If you’d like bucks, you have greatest choice than just taking out fully a payday loan.

This new Cash advance Trap

The newest advertising build pay day loan search simple: You pay a fee, you earn the money, and you also repay it along with your next salary. You either hop out a postdated glance at otherwise the checking advice having the financial institution, so that the financial works closely with the fresh new range. Continue lendo “Ca Payday loan: State Regulation and just how Lenders Avoid it”